M1 Finance Reviews – Read What All Say About Their Finance Super App

We have compiled M1 Finance reviews from various audiences, including bloggers, expert reviewers, the brand itself, and most importantly, the normal consumer. Read What All Say About M1 Finance & their Finance Super App.

M1 Finance Meta Review - Insights and Highlights

Discover firsthand opinions about M1 Finance. Is it a hit or miss? We’ve aggregated user and pro reviewers feedback for you. below are the key takeaways:

Pros:

"Spending and borrowing options complement portfolio management. "

"Investment integrated with banking and line of credit. "

"Margin loans accessible at low interest rates with $5K invested. "

"No account management fees. "

"Competitive rates on margin accounts. "

"Extensive portfolio management customization options. "

"Dynamic Rebalancing."

"Users may choose from 6,000+ stocks and ETFs to create personalized portfolios. "

"Low account minimums. "

"Access to more than 80 professional portfolios. "

"Tools can help move your extra cash into investment accounts. "

"Low minimum deposit. "

"Automated investing available at no additional fee for standard accounts. "

Cons:

"Limited financial calculators, tools, and goal planning. "

"No tax-loss harvesting. "

"Lacks some of the features typically offered by full-service robo-advisors. "

"No aggregating of external accounts for investment allocation purposes. "

"No access to human advisors. "

"No tax loss harvesting available. "

Final Thoughts:

"As per the given above pros and cons, you might have got an idea that M1 Finance is a good platform. There are mostly pros about M1 Finance. There are not so many cons about M1 Finance. You can read more reviews and make an informed decision. "

What is the official website link of M1 Finance?

If you want to visit the official website of M1 Finance, then you can click this link .

What is the current best offer on M1 Finance?

The current best offer on M1 Finance is “Grab 50% Off Site-Wide”.

How to apply the coupons at M1 Finance?

You can apply these coupons at the checkout of M1 Finance.

What is M1 Finance?

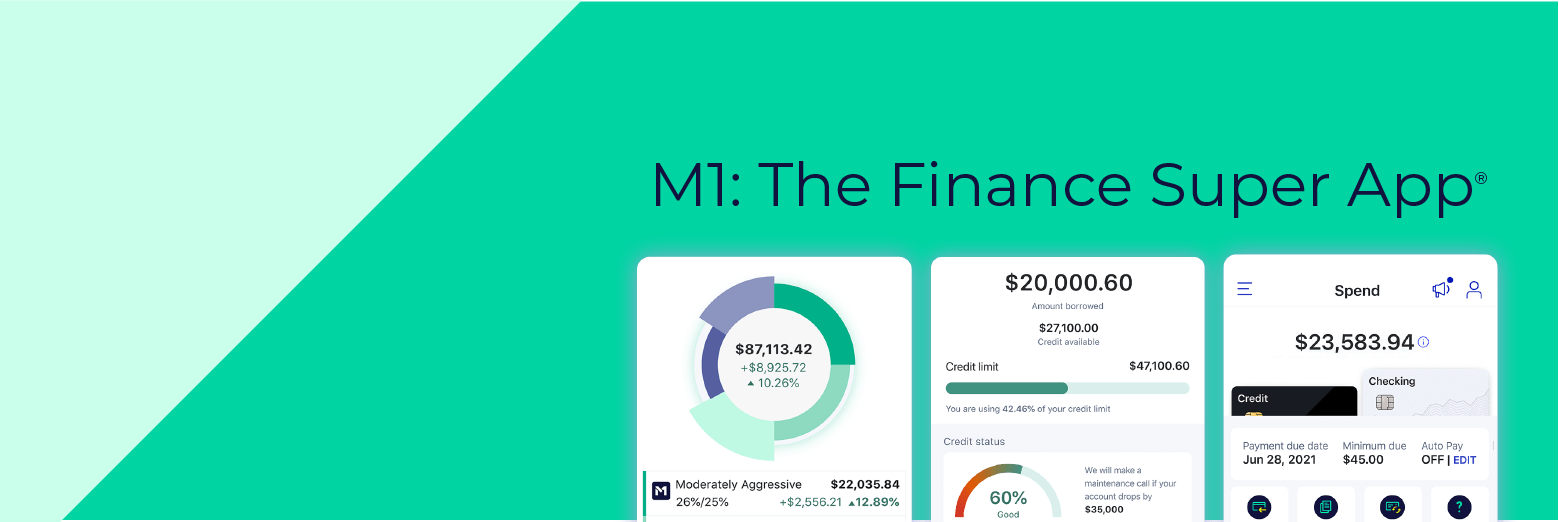

M1 Finance is an American financial services company. Founded in 2015, the company offers a robo-advisory investment platform with brokerage accounts, digital checking accounts and lines of credit.

Is M1 Finance licit?

M1 Finance is a brilliant option if you are interested in buying or selling ETFs and stocks. Its automatic account features make it suitable for passive investors. But since M1 Finance also offers the option of placing individual trades, it can work for active traders as well.

Can we use M1 finance for free?

M1 Finance sees costs at every turn: no commission fees, no account management fees, no checking account maintenance fees, no application or origination fees to borrow. This investment is expense ratio conscious to keep fund fees low and even reimburse ATM fees.

Which type of company is M1 Finance?

M1 Finance is a Private Held Company.

Does this platform sell crypto?

Unfortunately, M1 Finance does not sell Crypto. But still provides interest-based accounts and access to crypto-related stocks and shares, thus giving its users indirect exposure to the industry.

Who is the owner of M1 Finance?

M1 Holdings Inc. owns M1 Finance.